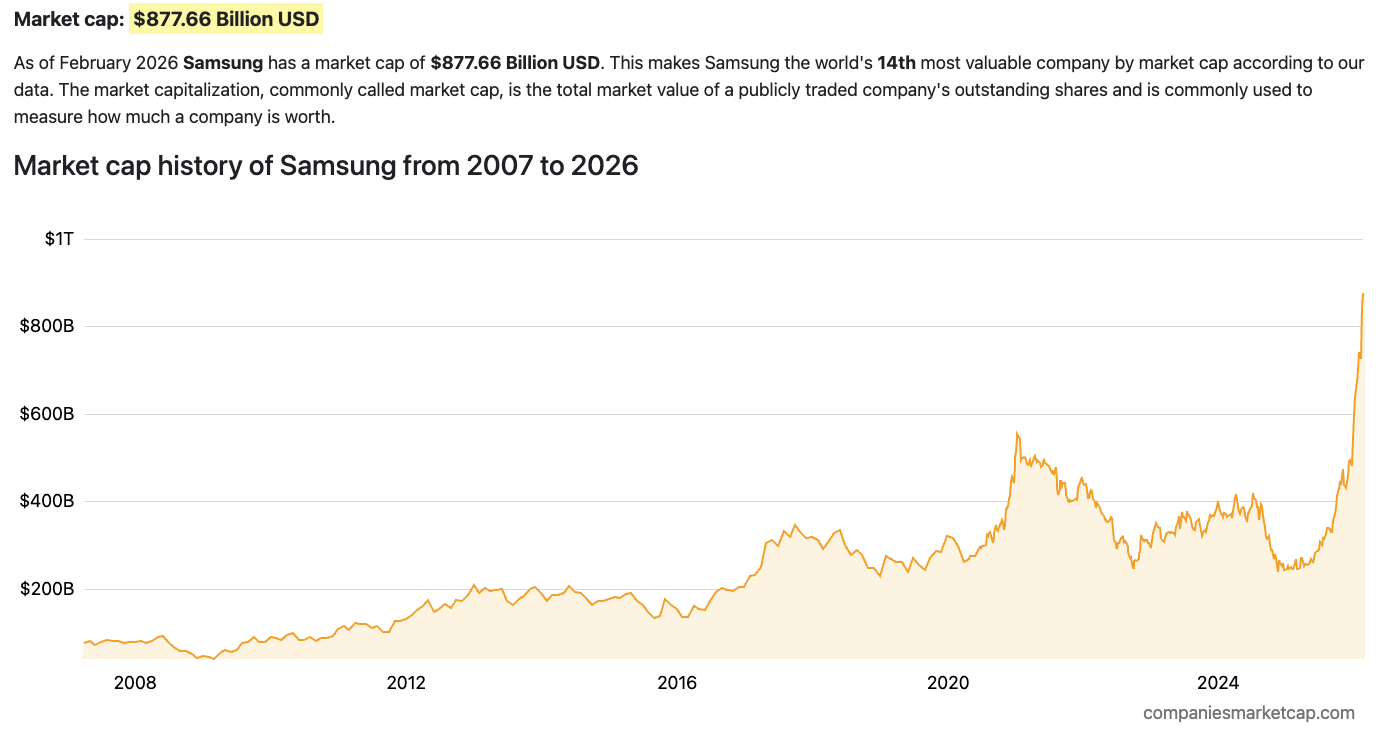

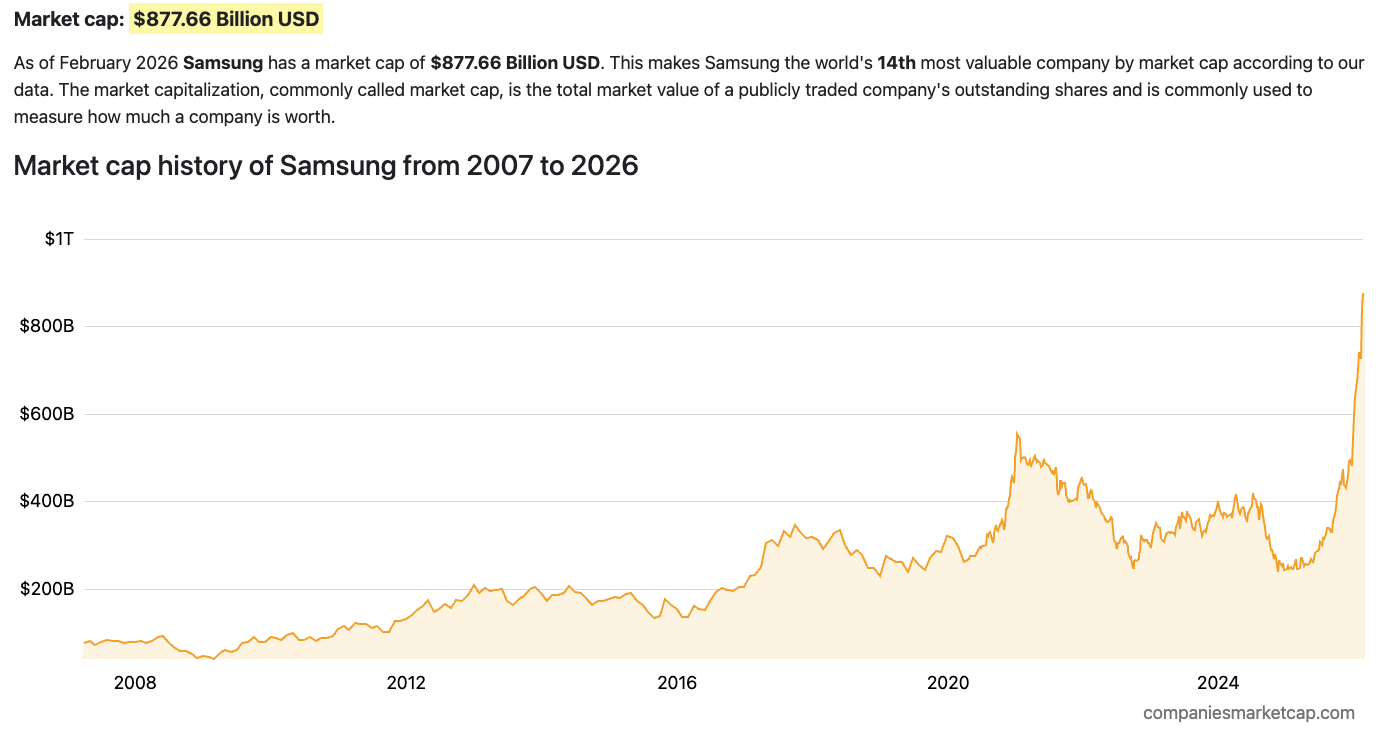

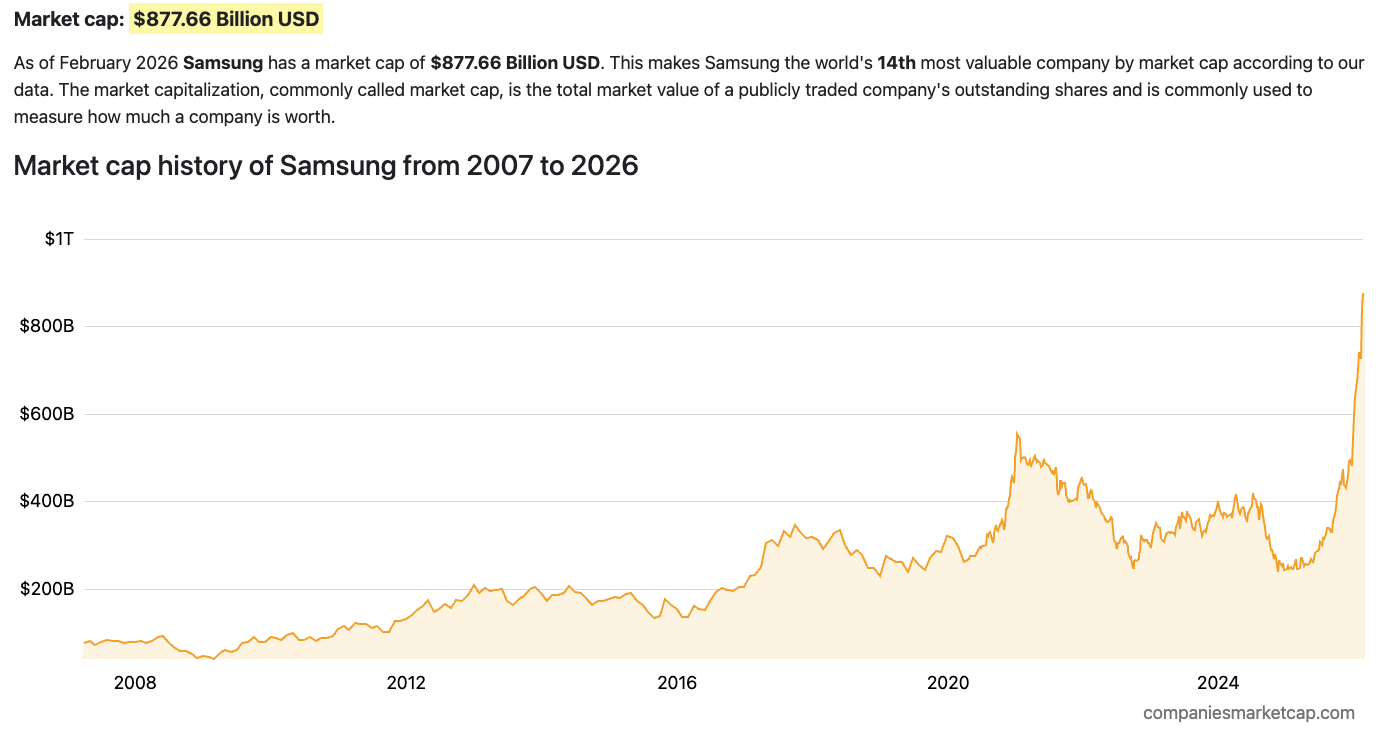

Samsung has been on a strong run over the past few months. The technology giant was struggling just last year, but its fortunes began to turn after it secured a $16.5 billion deal to manufacture semiconductor chips for Tesla. The South Korean firm’s valuation has now neared the $900 billion mark for the first time in its history, and it could even reach the elusive $1 trillion mark in the future.

Samsung Electronics’ current valuation stands at $876.24 billion, a sharp 358% increase from $244.51 billion last year. Its share price crossed the $130 mark earlier today. This meteoric rise in Samsung’s share price and valuation compared to a few days ago comes after a report from South Korea claimed that the company plans to price its HBM4 chips at $700 per unit, about 30% higher than last year.

Samsung, SK Hynix, and Micron are the only companies in the world capable of producing HBM3, HBM3E, and HBM4 chips. These chips are critical components in artificial intelligence (AI) accelerators used by hyperscalers and major global technology firms like Amazon, Alphabet (Google), Meta, and Microsoft.

Recently, Samsung became the world’s first company to begin mass production of HBM4 chips and is reportedly set to ship most of them to Nvidia, currently the world’s most valuable company. Samsung’s HBM4 and SOCAMM2 chips will be used in Nvidia’s upcoming Vera Rubin platform, which is expected to launch later this year and could become the world’s most powerful AI chip.

With many analysts expecting the memory chip shortage to continue beyond 2027, Samsung is well positioned for revenue and profit growth. The company’s HBM4 chips are also reported to deliver leading performance in the market.

The post Samsung nears $900 billion valuation for the first time appeared first on SamMobile.

Post a Comment